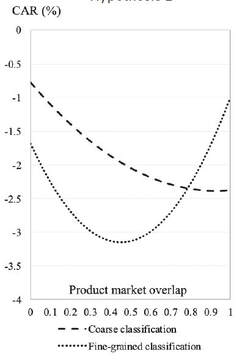

People dislike fraud, so much in fact that they see it as immoral and are willing to make some sacrifices to punish the fraudsters. This is even true when they are trying to earn money through investments. The best evidence on this is from research on individual people managing their personal money, but in today’s stock market most of the money is moved around by professional fund managers who are simply looking for returns. Does the market still have any morals? Research by Ivana Naumovska and Dovev Lavie published in Administrative Science Quarterly suggests there are some morals left, but they are… selective. They looked at firms involved in financial misconduct, which is the kind of misconduct that investors care the most about because it hurts them directly. (They might be more forgiving of pollution.) It is already known that investors react by withdrawing money held in the firm accused of misconduct—and also from similar firms, because the stigma of misconduct places similar firms under suspicion. This research goes one step further by asking whether investors are not just reacting to stigmatization but are also strategic in how they respond. An interesting feature of similar firms is that many of them don’t just resemble each other; they also compete with each other. A firm engaged in misconduct is weakened by money withdrawals and other punishments, so shouldn’t that strengthen its competitors? If it does, then that could be a reason to bet money on the competition, even if it is similar. Again, a selective form of morals. In fact, the research went even further. Recognizing that investors differ in how well they understand how firms compete, Naumovska and Lavie distinguished between the detailed analysis of firms done by mutual funds and hedge funds and the coarser understanding of other investors. All investors will react to stigmatization and competition, but the more sophisticated investors will be less sensitive to stigmatization and more sensitive to competition. More forgiving and more strategic, in other words. Were they? Absolutely. Measuring stock market returns, it was easy to show that both stigmatization and strategic investment took place. The authors found a U-curved relation between stock market returns and the product market overlap of each firm with the firm accused of misconduct, such that intermediate levels of similarity were the worst. Importantly, less sophisticated investors punished firms more if they were more similar to the firm accused of misconduct, showing no strategic investment. The more sophisticated investors also reacted negatively to any level of misconduct but were significantly more forgiving if the two firms were so similar that the damage suffered by the accused firm might turn out to be profitable for the other firm. So does the stock market still have morals? Some morals, and selective morals. A somewhat disturbing conclusion is that those of us who prefer to let others invest our money through mutual funds and ETFs (not hedge funds, I hope) actually make the market less of a moral place, because those who manage our money are less willing to deal out punishment for misconduct. How much of a problem is that? Arguably punishing firms that are similar to one that commits any form of misconduct may be unfair because one should be presumed innocent until found guilty. But that overlooks some important details. First, people are presumed innocent, but we don’t need to hold firms to the same standard. Second, the stock market is not a court, and it is perfectly acceptable to move money away from the possibility of future misconduct. I am perfectly comfortable with stock market morals through stigmatization, and I am uneasy about the implications of this research. Naumovska, Ivana and Dovev Lavie. 2021. When an Industry Peer is Accused of Financial Misconduct: Stigma versus Competition on Non-accused Firms. Administrative Science Quarterly, forthcoming. Comments are closed.

|

Blog's objectiveThis blog is devoted to discussions of how events in the news illustrate organizational research and can be explained by organizational theory. It is only updated when I have time to spare. Archives

May 2024

Categories |

RSS Feed

RSS Feed