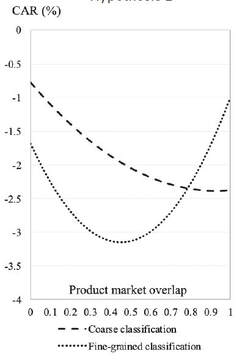

Here is a piece of conventional wisdom that I and many others firmly believe: Nepotism is the enemy of good management because it places untested and often unqualified people in important positions simply because of who their parents are. Most of us do not work in organizations owned and controlled by families, and even some of us who do are working in organizations owned by families but controlled by professional managers who have been carefully selected. Then there is the rest of us, who worry about the capabilities of the owner family child in an executive role, and who have read the news about scandals such as the Samsung family ownership. But every now and then some evidence appears that gives us reason to rethink our beliefs. In a paper published in Strategic Management Journal, Guoli Chen, Raveendra Chittoor, and Balagopal Vissa look at CEO pay in family firms in India, comparing those run by CEOs from the family versus those run by non-family CEOs. Their findings contained some surprises. Here is an unsurprising finding: CEOs from the family get paid more. Sure, we all know about favoritism and about extracting resources from a firm (which also has non-family owners) to put into the family’s pockets. This is an annoying finding, but it is no surprise. Oh and by the way, the increase in pay depending on the firm performance is nearly the same for low and high performance provided the CEO is a family member, but a nonfamily CEO does not benefit from higher performance. Here is a surprising finding: When they checked the data more carefully, they found that the family CEOs actually got rewarded very much when the firm had very high performance, less so when it had average or low performance. This is exactly how one would design an incentive scheme for CEOs, because disproportionate rewards at the high end are necessary to compensate for their reluctance to take risk. But why is the incentive scheme especially well designed for family member CEOs? One more interesting surprise that might be telling: The relation between high performance and higher pay is particularly strong if the firm is named after the family. So, exactly the kind of firm that would embarrass the family if the performance were low has a family CEO with good incentive pay. Interesting way for the family to control their (younger) CEO member, right? You have probably read through this and concluded that it does not matter. Having a good incentive scheme is not the same as getting high performance. After all, poorly qualified spoiled brats are not going to accomplish much regardless of how they are rewarded. True, except for one thing. The firms managed by family CEOs had higher performance on average than those managed by nonfamily CEOs. This is certainly a paper to make us reconsider our beliefs. Chen, G.,R. Chittoor, B. Vissa. 2021. Does nepotism run in the family? CEO pay and pay-performance sensitivity in Indian family firms. Strategic Management Journal 42(7) 1326-1343.  People dislike fraud, so much in fact that they see it as immoral and are willing to make some sacrifices to punish the fraudsters. This is even true when they are trying to earn money through investments. The best evidence on this is from research on individual people managing their personal money, but in today’s stock market most of the money is moved around by professional fund managers who are simply looking for returns. Does the market still have any morals? Research by Ivana Naumovska and Dovev Lavie published in Administrative Science Quarterly suggests there are some morals left, but they are… selective. They looked at firms involved in financial misconduct, which is the kind of misconduct that investors care the most about because it hurts them directly. (They might be more forgiving of pollution.) It is already known that investors react by withdrawing money held in the firm accused of misconduct—and also from similar firms, because the stigma of misconduct places similar firms under suspicion. This research goes one step further by asking whether investors are not just reacting to stigmatization but are also strategic in how they respond. An interesting feature of similar firms is that many of them don’t just resemble each other; they also compete with each other. A firm engaged in misconduct is weakened by money withdrawals and other punishments, so shouldn’t that strengthen its competitors? If it does, then that could be a reason to bet money on the competition, even if it is similar. Again, a selective form of morals. In fact, the research went even further. Recognizing that investors differ in how well they understand how firms compete, Naumovska and Lavie distinguished between the detailed analysis of firms done by mutual funds and hedge funds and the coarser understanding of other investors. All investors will react to stigmatization and competition, but the more sophisticated investors will be less sensitive to stigmatization and more sensitive to competition. More forgiving and more strategic, in other words. Were they? Absolutely. Measuring stock market returns, it was easy to show that both stigmatization and strategic investment took place. The authors found a U-curved relation between stock market returns and the product market overlap of each firm with the firm accused of misconduct, such that intermediate levels of similarity were the worst. Importantly, less sophisticated investors punished firms more if they were more similar to the firm accused of misconduct, showing no strategic investment. The more sophisticated investors also reacted negatively to any level of misconduct but were significantly more forgiving if the two firms were so similar that the damage suffered by the accused firm might turn out to be profitable for the other firm. So does the stock market still have morals? Some morals, and selective morals. A somewhat disturbing conclusion is that those of us who prefer to let others invest our money through mutual funds and ETFs (not hedge funds, I hope) actually make the market less of a moral place, because those who manage our money are less willing to deal out punishment for misconduct. How much of a problem is that? Arguably punishing firms that are similar to one that commits any form of misconduct may be unfair because one should be presumed innocent until found guilty. But that overlooks some important details. First, people are presumed innocent, but we don’t need to hold firms to the same standard. Second, the stock market is not a court, and it is perfectly acceptable to move money away from the possibility of future misconduct. I am perfectly comfortable with stock market morals through stigmatization, and I am uneasy about the implications of this research. Naumovska, Ivana and Dovev Lavie. 2021. When an Industry Peer is Accused of Financial Misconduct: Stigma versus Competition on Non-accused Firms. Administrative Science Quarterly, forthcoming.  An important part of the move towards firms showing social responsibility is the spread of social impact work programs. These programs let employees offer part of their time to various initiatives with social impact. For example, my school has built a playground in an area of need. (I agree that a playground built by professors is a scary thought, but most people working for us are not professors.) Social impact work programs are thought to be very useful because they connect organizations and society much better than money donations, and many firms encourage them. What if the same firms penalize the workers who take part in them? That would make no sense, but now we know it is happening. This is thanks to research by Christiane Bode, Michelle Rogan, and Jasjit Singh published in Administrative Science Quarterly. They looked at a major consulting firm with a social impact program that employees could volunteer for, and they checked what happened to the promotions of those who did or did not volunteer. The good news is that it is fine to work for social impact if you happen to be a woman. Then there is all the bad news. First, the promotions of men who worked for social impact were delayed. Bad for them, who thought that the firm’s promise to encourage and reward social impact would be followed up. Bad for the firm, which claimed to want a robust social impact program. Second, the promotions of men who worked for social impact were delayed. Bad for the firm’s (and the world’s) idea that professional workers are generally evaluated based on merit, not gender, because the difference between men’s and women’s consequences clearly demonstrates a workplace with some sexist views. Third, the promotions of men who worked for social impact were delayed. Perhaps one of the more disturbing findings from this research was that this effect was not specific to the consulting firm. It could also be shown in a random sample of people acting as evaluators for a potential promotion. Their evaluations were very informative, and not in a good way. First, it was clear that the negative evaluation of men doing social impact work was entirely due to men making promotion evaluations. The male evaluators were the ones who acted as if they thought that men – but not women – should stay away from social impact. Moreover, when reporting the reason for their negative evaluations of men, they were clear that a lower fit to the job was the problem. Doing good outside the job does not lower a woman’s fit to the job, but it lowers a man’s fit to the job. What is going on here? The findings raise a clear suspicion that the evaluators either know that women do lots of non-work work anyway (like most family work) or think that a dual work and society focus is fine for women but not for men. The findings are discouraging because they suggest that a lot of education is needed to make social impact work a safe and gender-balanced effort for firms. The good news is that it is not too hard to accomplish because promotions are decided by a well-defined group of people, and it is easy to track how well they make decisions. In fact, the main reason the consulting firm findings were so clear is that they had good performance statistics for their employees, so it was easy to check whether the promotions were fair or not. This is exactly the foundation needed to make sure that promotion evaluators act in ways that match firm priorities, not oppose them. Bode, Christiane, Michelle Rogan, and Jasjit Singh. 2021. Up to No Good? Gender, Social Impact Work, and Employee Promotions. Administrative Science Quarterly, forthcoming. |

Blog's objectiveThis blog is devoted to discussions of how events in the news illustrate organizational research and can be explained by organizational theory. It is only updated when I have time to spare. Archives

May 2024

Categories |

RSS Feed

RSS Feed