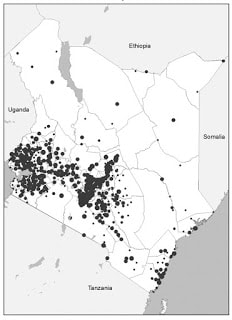

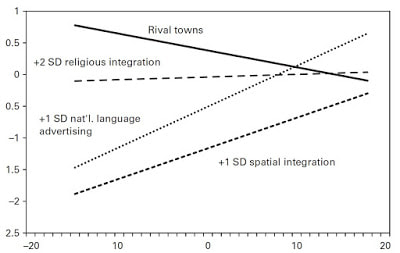

The nations that are Western, Educated, Industrialized, Rich, and Developed (WEIRD) have long experience with markets and democracy and are rightly proud of these. They hold the world’s oldest joint stock company (established in 1288 in Sweden), stock market (1602, in the Netherlands), and democracy (930, in Iceland). But they also started the world’s greatest economic downturn (1929, in the U.S.) and greatest war and genocide (1939, in Germany). Now that we have entered an era with significant threats to markets and democracy, it may be time for the WEIRD nations to learn something from Kenya. Kenya is a complex nation with markets threatened by distrust and corruption and democracy threatened by ethnic divisions and conflict. This makes it ideal for studying the formation of trust in the form of stock market participation spreading beyond the well-connected elite, creating a market for investment that includes many ethnic groups and income levels. An article by Christopher B. Yenkey in Administrative Science Quarterly looks at how this was done and has many useful lessons for those who want to maintain and grow trust in markets and societies across the world. Let me take just one example of what we can learn from Kenya. Investments require some level of trust, which is difficult in a society in which some banks are corrupt and people worry about what other ethnic groups might do to them. How is this trust created? As the figure to the right shows, it spreads from many starting points as citizens hear about others nearby making investments and gaining profits from them. The decision to invest is determined by the balance between fear and hope, and both are influenced by what happens to other people. Importantly, people pay attention both to their own ethnic group and other ethnic groups, and they can learn from the experiences of those they do not fully trust. What if the distrust is so strong that it amounts to rivalry? Some of Kenya’s ethnic groups saw each other not only as different and untrustworthy but also as rivals for economic and political power, so we know the answer to that too. The figure below shows that more-successful rivals pushed people away from the stock market, suggesting that potential investors came to see the profits of the rival ethnic group as a sign that the rival controlled the market, so that they could not profit from it. The figure also shows some easy ways of making this effect go away. Religious integration in the communities also integrated markets. Advertising that emphasized nation over ethnic group (by using the shared language) also integrated markets. Finally, spatial integration – having neighbors who were of the rival group – had the same effect. All of these mechanisms helped spread participation in the stock market for low-income Kenyans, helping their income and the economic growth of the nation. Democracy means contests for power, and these contests can be done in many ways. Tribalism and distrust may help someone gain loyal followers, but at the cost of tearing up the trust that underlies markets and the democracy. Kenya teaches us how the torn fabric of trust can be mended, as one of the many steps needed for a society in which everyone is welcome to contribute and gain rewards. |

Blog's objectiveThis blog is devoted to discussions of how events in the news illustrate organizational research and can be explained by organizational theory. It is only updated when I have time to spare. Archives

May 2024

Categories |

RSS Feed

RSS Feed